Table of content

Negative nominal interest rates are a relatively new phenomenon in the world economy. The first central bank to resort to those policies was the Swiss National Bank when it introduced the -0.25% rate all the way back in December 2014. In response to the collapse of the 1.20 floor for EUR/CHF, the SNB went even further cutting rates down to -0.75%.

This was followed by the Swedish Riksbank in 2015 when it adopted a -0.1% rate, reducing them even further to -0.5%. However, here it has to be mentioned that the Swedish central bank did eventually decide to end the negative interest rate policy and returned rates to 0% in December 2019. Despite the economic challenges brought by the outbreak of the COVID-19 pandemic, the bank left the rates unchanged.

The third and so far the last central bank which adopted the negative interest rates, was the Bank of Japan when it reduced rates to -0.1% back in 2016. However, unlike the Swiss National Bank and Swedish Riksbank, the Japanese policymakers had not made any further changes since 2016.

Here it is worth mentioning that currencies with a negative interest rate were unheard of before this period. However, after the 2008 great recession, the heavy majority of the world’s major central banks have already reduced their rates to close to zero. So essentially they were out of ammunition when it came to tackling challenges of economic downturn. At the same time, the inflation rates in Switzerland, Japan, and Sweden were very low, frequently crossing into the negative territory.

Therefore those three central banks mentioned above, have decided to adopt negative interest rates, in order to stimulate borrowing, discourage the growth of savings in those countries, and consequently, help the inflation to return to its medium-term target. The results of those policies were quite mixed. In some cases, the central bank did succeed to temporarily boost the Consumer Price Index (CPI), however in terms of economic stimulus it did not have much beneficial effect to speak of.

Yet, one result of those policies was the fact that the central banks did succeed to weaken their respective currencies and halt their appreciation.

Negative Interest Rates Explained

The very reason why some central banks have decided to resort to negative interest rates and why some of them are still considering this sort of policy lies in the problem of what economists call the ‘liquidity trap’. The basic idea behind this term is that when the given central bank lowers rates to zero, it can not offer further stimulus by cutting the interest rates further. As a result, 0% interest rates is the lower-bound for monetary policy for many banks.

The reasoning behind this argument is very simple. Despite all of their influence and resources, central banks are not in a position to enforce negative rates on households and businesses. If policymakers start charging interest rates to commercial banks for holding deposits with them, it will not guarantee that this policy will be successfully passed on to consumers.

After all, if financial institutions started charging interest rates for holding deposits to their clients, then it is highly likely that the majority of them will simply withdraw money or transfer it to current accounts, where they will not face such charges. This can easily lead to liquidity problems for commercial banks. Alternatively, bank customers may decide to convert their savings into another currency, which does not have negative rates. This in turn can lead to significant currency depreciation.

Therefore, the effects of negative interest rates sometimes can be highly unpredictable and can lead to a lot of unintended consequences. Despite all of those potential risks, those three central banks we mentioned above, have all taken this ultimate step.

The reasoning behind this was that the Bank of Japan, Swiss National Bank, and Swedish Riksbank simply could keep inflation rate away from negative territory and return it to their respective targets. Clearly, 0% interest rates were not enough to achieve this purpose. Therefore, for those policymakers, the next logical step was to move interest rates into the negative territory.

Obviously, this was not the universally accepted approach across the globe. Many other central banks, including the US Federal Reserve, the Bank of England have decided to keep rates near-zero levels for several years and also implement the quantitative easing programs. It is highly likely that one of the reasons for this choice was the fact that the policymakers in those institutions were well-aware of the potential risks associated with the adoption of the negative rates.

Luckily, we already have 3 examples of such policies to analyze and to find out what potential benefits and disadvantages they have. Therefore let us go through each of those in more detail.

How Negative Rates Work in Switzerland

Nowadays many market participants across the world have never experienced currencies with negative rates. For them, it might seem curious how this could be implemented and how investors and savers can protect themselves from the effects of those policies.

As we mentioned earlier, the Swiss National Bank was the first such financial institution in the world to openly adopt negative interest rates. The country is surrounded by Eurozone members, which make up 80% of Switzerland’s exports. Therefore the SNB’s position was that the shart appreciation of Swiss franc could do significant damage to the country’s economy. The strengthening of CHF could make the Swiss exports much more expensive for the Eurozone consumers and consequently, less competitive.

This potentially could have negative effects: it could hurt the Swiss trade balance, moving it into negative territory. Also since net exports are one of the four main components of the Gross Domestic Product (GDP), any loss in competitiveness could also lead to a decline in the rate of economic growth.

Therefore, in order to tackle those risks, the Swiss National Bank has introduced a 1.20 floor for EUR/CHF exchange rate. According to this policy, the SNB would not intervene if the rates stayed above this level and even if the Euro made some significant gains. However, the Swiss policymakers would intervene if the EUR/CHF tried to go below the 1.20 level.

The SNB had another long term issue. The Swiss consumer prices stayed mostly flat since the 2008 crisis, with the Consumer Price Index (CPI) frequently crossing into the negative territory. The reduction of the main interest rate to 0% did not have enough of a stimulating effect on inflation. Therefore, the Swiss policymakers were considering whether they would go for a massive quantitative easing program as the US Federal Reserve and Bank of England did, or resort to negative interest rates.

By late 2014 there was increasing speculation in the market that the European Central Bank was likely to announce its own quantitative easing program. This in turn would have led to significant selling pressure with EUR/CHF pair. The Swiss National Bank responded to cutting rates to -0.25% in December 2014 and then to -0.75% in January 2015, as the SNB decided that the 1.20 floor was unsustainable and abandoned the policy.

At this point, many people had no idea how negative interest rates work. Eventually, the Swiss commercial banks and their clients came to some sort of arrangement. Current and savings account up to 250,000 CHF are not typically subject to -0.75% interest rate. This allowed those banks to avoid the massive outflow of cash. Also, this policy permitted many ordinary customers to save money on the bank account without facing those charges. In fact, some Swiss commercial banks do permit some clients, who use loan products to store up to 500,000 CHF on their accounts, without being charged with -0.75% interest rate.

On the other hand, those high net worth individuals who held higher balances on the bank accounts started losing a considerable amount of money on a regular basis. As a result, this created a powerful incentive for those investors and savers to convert their CHF holdings into US dollars and other currencies with no negative interest rates.

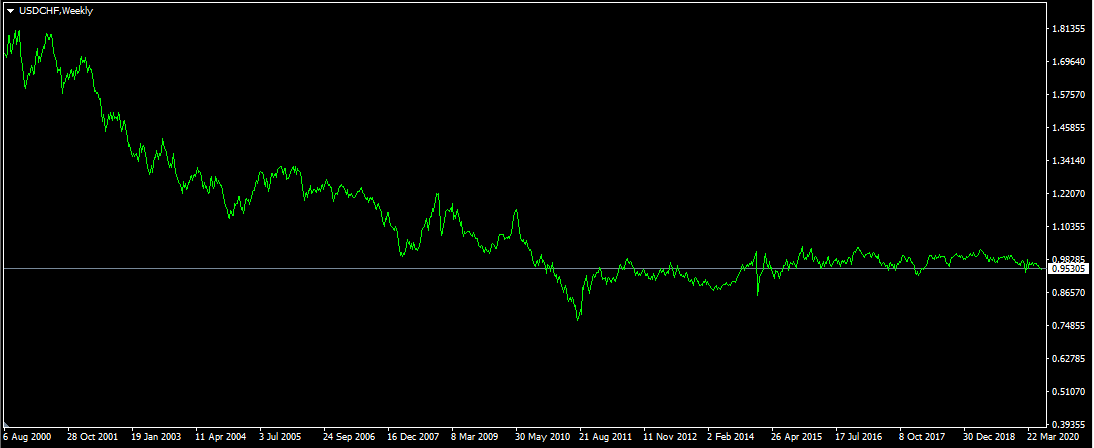

It goes without saying that this had a very negative impact on the value of Swiss franc. Therefore, in order to illustrate how negative interest rates work in Forex exchange rates, let us take a look at this daily USD/CHF chart:

Here it is worth noting that before the introduction of the negative interest rates by the Swiss National Bank, CHF was in a long term uptrend against nearly all major currencies. As we can see from the chart above, the USD/CHF has dropped from 1.72 in 2000 to 0.86 in 2011.

However, as the SNB has firstly adopted a 1.20 floor with the Euro and then moved on to the negative interest rates, the situation changed dramatically. The US dollar has regained some of its losses and USD/CHF has settled within a 0.90 to 1.05 range. Here it is worth noting that this stalemate has persisted for more than 5 years now. Therefore as we can see from this example, the Swiss National Bank did manage to halt the long term appreciation of the currency and achieve its depreciation to a certain degree.

The representatives of the SNB have also recently stated that the bank is ready to cut rates even further if needed. This means that at some point we might see Swiss rates at -1% or even lower.

Because of very low inflation, the Swiss currency might be an attractive choice for many savers. However, the negative interest rate policies make this very expensive for consumers. As a result, if the Swiss National Bank decides to reduce rates even further, this might lead to a significant depreciation of the Swiss currency.

Japanese Approach to Negative Interest Rates

As we have discussed before, SNB has essentially adopted an all-in policy, cutting rates all the way down to -0.75% and threatening to reduce them even further. However, this aggressive approach does have significant risks and can easily lead to the massive depreciation of the currency.

Therefore, the Bank of Japan has adopted a completely different approach. The Japanese policymakers have decided to reduce rates to -0.1% back in 2016 and keep it at that level for the subsequent years. This was indeed a more moderate approach. This lets Japanese consumers and companies borrow money at very low rates, without penalizing savers to such extent to force them to flee JPY denominated assets.

The reasons behind the adoption of the negative interest rate policy were the long term issue with inflation. Since the late 1990s, the Japanese Consumer Price Index (CPI) very frequently crossed into the negative territory and mostly stayed very close to zero. Before 2012 the Bank of Japan was aiming at 1% annual inflation, yet this failed to get the Japanese economy out of deflation. Consequently, since 2012 the Japanese policymakers have adopted a 2% CPI target and tried to achieve this by a massive quantitative easing program, coupled with a -0.1% interest rate since 2016.

So how did the currency with the negative interest rate pattern perform after the adoption of those policies? In order to respond to this question let us take a look at this daily USD/JPY chart:

As we can see from the above diagram, the short term reaction of the currency pair was the massive appreciation of the US dollar, with USD/JPY rising from 100 to 118 level. However, after those extreme moves, the exchange rate stabilized and during the subsequent years have settled within 105 to 115 range. So as we can see from this example, the Bank of Japan did manage to devalue the Japanese yen by a significant degree and then stabilized the currency rate.

As for the inflation targeting, for several years, the Japanese policymakers did manage to raise CPI to 2% and keep it close to that level for some time. However, this was relatively short-lived as the inflation rate still fell to close to zero during some years after the adoption of the policy. However, here it is worth mentioning that the Bank of Japan did manage to keep CPI from deflation levels, except during the brief period in 2016. The outbreak of COVID-19 pandemic, with its subsequent travel bans and lockdowns, has significantly reduced the amount of overall economic activity.

As a result of this process, the Consumer Price Index in Japan fell steadily, eventually dropping all the way down to 0%. Therefore, at current rates, the country is very close to deflation territory. Consequently, if this trend continues, then the Bank of Japan might decide to respond to those developments with further interest rate cuts or with the expansion of its quantitative easing program.

The Bank of Japan’s 2% inflation target is not the only reason why deflation is undesirable for Japanese policymakers. Here it is worth mentioning that the debt to GDP ratio of the country has already surpassed 200% back in 2019 and is projected to reach 250% before 2025. In this situation, the last thing the Japanese government wants is for its debt to gain purchasing power. The prolonged period of deflation will increase the real value of those liabilities. As a result, servicing those debts will become even more difficult to sustain, leading to a sovereign debt crisis and potential default.

Therefore, to avoid such a scenario the Bank of Japan strives to achieve a 2% inflation target. This will slowly devalue the overall liabilities of the Japanese government, making it much easier to sustain. Obviously, there are also millions of Japanese citizens who have their mortgages denominated in JPY, therefore deflation can be very problematic for their household budget.

Therefore, the reasoning behind those decisions seems to be quite logical. However, as mentioned before the adoption of the negative interest rates can have many unintended consequences. This risk might become even more considerable if the Bank of Japan decides to cut the rate even further. The reason for this is the fact that the Japanese commercial banks can absorb -0.1% rates without being forced to charge its customers negative interest rates.

This is possible because those financial institutions can offset those losses with spreads on loan products. However, if the Bank of Japan decides to follow the example of the Swiss National Bank and cut rates to -0.75%, then this task will become much more difficult. At that stage, the commercial banks will most likely be forced to pass on some of those rates to its customers. However, for the sake of accuracy, it has to be mentioned that so far the Bank of Japan made no indication that it would take such a course.

Forex Rates of SEK After Introduction of Negative Interest Rates

The Swedish Riksbank was the second central bank in the world, which introduced negative interest rates. This happened back in 2015, when it dropped rates to -0.1%, eventually reducing it further to -0.5% during the following year. Just like in the case of the Bank of Japan, the main reason behind this move was the fact that the inflation rate has deviated significantly from the target, eventually slipping into the negative territory.

However, unlike with the Bank of Japan and Swiss National Bank, the Swedish Riksbank did eventually end the policy before 2020. In December 2020, the central bank raised rates to 0% and kept it to that level for the following months.

So how did the negative rates affect the FX rate of Swedish Krona? In order to answer this question, let us take a look at this daily USD/SEK chart:

As we can see from the diagram above, from 2016 until 2018 the currency pair mostly moves sideways, mostly remaining within 7.9 to 9.1 range, eventually dropping to 7.85 level. However, after this point the US Federal Reserve has stepped up its rate hikes, increasing the divergence between the two central banks. As a result, the pair has risen steadily, eventually reaching 10.38 level during March 2020.

After reaching those extreme levels, the rate moderated and stabilized close to 9.40 mark during June 2020. The reasoning behind this move was the fact that in response to the outbreak of the COVID-19 pandemic, the US Federal Reserve has reduced rates back to 0% to 0.25% range. At the same time, the Swedish Riksbank has held rates to 0%. As a result, there was very little difference between those two policies and the USD/SEK pair has settled for a range of trading.

Therefore the currency, which has negative interest rates, had a negative correlation with the exchange rates of higher-yielding currencies.

Trading Currencies with Negative Interest Rates – Key Takeaways

- There are not a large number of currencies with negative interest rates. The Swiss National Bank was the first central bank which introduced this policy, when it cut rates to -0.25% back in 2014, followed by another reduction to -0.75%. Due to deflationary tendencies in their respective countries, the Bank of Japan and Swedish Riksbank have also decided to follow the same policies, cutting rates to -0.1% and -0.5% respectively.

- The past historical experience tells us that it might not be the best idea to open long positions for currencies with negative interest rates. Everything else being equal, those currencies usually tend to depreciate against their pairs over the long term. The reasoning behind this is the fact that savers and investors are penalized for holding their capital in that currency and therefore have a very strong incentive to convert their savings to another currency, which does not have such charges.

- Some central banks adopted the negative interest rate policy in order to prevent their respective economies from slipping into deflation. This also had a side effect of weakening their currencies as well, which might have been a piece of good news for some policymakers. However, here it has to be mentioned that the Swedish Riksbank did put an end to those policies and increased its key rate to 0%, once the inflation has returned to its objective.