The Forex trading world is full of scams and fraud. Some of these scams have attractive appearances outside and manage to lure customers with a nice-looking website, and various claims of being the best, having the lowest spread, having high bonuses, etc. Alternatively, some legit brokers fail to seem legit and good. CP Markets Forex broker falls in the first category of having a well-looking and informative website but lacking in the regulations department. The brokerage has four different trading accounts and offers its financial services to a worldwide audience with some exceptions. To open an account with the broker trader needs to deposit a minimum of 50 USD, with that, clients can trade with 1:200 leverage and choose from over 150 trading instruments. The broker offers multiple payment methods and a MetaTrader 5 trading platform. The spreads also seem average at 1.2 pips and trading commissions are average. But can this broker be trusted? Let’s delve deeper into our Cooper Markets review to see all the details that you should be aware of.

The safety and security of the CP Markets

To see how legit the broker is, the first thing to check is the regulations and the background of the company that operates it. CP Markets is the brand name of the company CP Markets Limited. The company is registered in Vincent and the Grenadines and probably has some kind of office there as the contact phone number is from the offshore country as well. The registration number can be seen on the website, it dates back to 2018, meaning that the brokerage was registered that year. In that regard, the broker is still young and improvements in the regulations department are possible. As for the license number, it is not indicated on the website at all, seemingly the broker does not have a license from the local financial regulator. As the broker is registered offshore it is not reliable for the traders anywhere in the world. Is CP Market legit since it does not have a license? No. The broker is not authorized to provide trading services to the residents of any country. As for the company’s background, there is not much information available about it, meaning that the company is newly established. Since the broker is not regulated it gets a deficient rank from our review in the safety department.

Fees and spreads of CP Markets

The spreads for commission-free accounts start from 1.2 pips. As for commissions on zero-spread accounts CP Markets charges its clients with 3.5 USD per side per lot. As the broker mentions the spreads are zero for these accounts most of the time. Previously the spreads were painstakingly high from 2.6 pips, but now the broker seems to address this issue well. There is no information about deposit and withdrawals fees and we assume the broker charges some. All in all the fees seem very well fit into the industry’s overall character and do not stand out in any positive or negative way.

CP Markets Accounts, deposits, and withdrawals

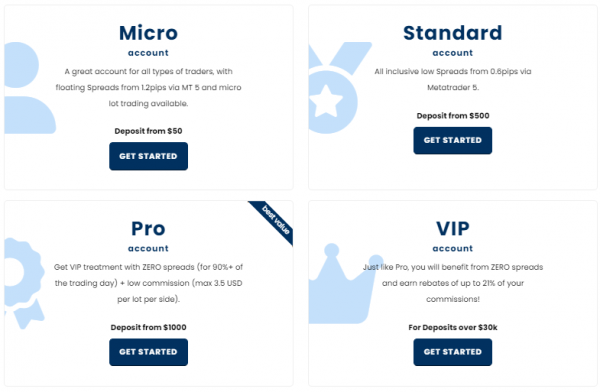

There are currently four accounts available with CP Markets. Micro, standard, pro, and VIP accounts. The trading terms seem very attractive on these accounts, but since there are this many red flags about regulations and withdrawals we do not recommend them to our readers. The leverage is up to 1:200, and there is a possibility of using a smartphone for trading. These are all the features that lower CP Market’s rating, as brokers usually have a dedicated account manager, access to educational materials, and many more additional and valuable features.

The minimum deposit for a micro account is 50 USD, for the standard account traders will need 500 USD, 1000 USD is required for the Pro account, and the VIP account will require from clients at least 30k.

The broker also lowered spreads which is improvement.

CP Markets deposits and withdrawals

As mentioned there is no information about CP Markets withdrawals. The website does not even mention withdrawal. The information is available in the attached documents such as terms and conditions, but this document does not state anything about the time that is needed for withdrawal or if there are any fees related to it. There must be information about commissions for ECN accounts, as these accounts are always charged with a small commission, but there are no details about it either. This is not a good sign definitely, not disclosing your withdrawal policies only indicates possible shady activities from CP Markets and since the broker is not regulated this is a huge red flag.

CP Markets Trading Assets and Features

As for the offered trading instruments, there are diverse asset classes offered by the broker, namely

- Forex

- Cryptocurrencies

- commodities

- Indices

- Shares CFDs

- Futures

The asset types offered are numerous as we can see, if there were no serious red flags CP Markets could be considered a well-established broker that offers a decent amount of tradable instruments.

Website Overview

The website was updated and it is looking very professional and useful now. The broker’s website should provide all the information a person might need to know, such as the list of the trading asset, the real picture of how the spread looks like with the broker, information about deposits and withdrawals, information about commissions, etc. Unfortunately while preparing the Coopermarkets.com review we were unable to find the exact information about deposit and withdrawal methods and fees, since the broker does not display details of it. Usually, the lack of information is for one simple reason, the broker is fully aware that the service it is offering is either bad or it has not thought about these parts yet. Either way, the improvement is needed in this aspect of the website.

Another thing that should ring your mind is that there is no FAQ section on the website. I could understand it if everything was explained in detail on the website, but there is no information given there as well. So it is truly a matter of concern. Several languages have been added since our first review, but the FAQs section and a few other still requires attention and improvement.

While the broker can be found on almost all social media channels such as Facebook, Instagram, LinkedIn, Twitter, Telegram, YouTube, and Pinterest the broker is not active, it does not have any posts or followers. More importantly, the broker claims that it was opened in 2016, but all the accounts were created in 2018. As mentioned above, the broker’s registration number also shows the 2018 year. So can CP Markets be trusted when it is lying about the year of its establishment?

Customer Support Review of CP Markets – Do they care?

All we could gather from the broker’s website regarding support is a very shady address of the company without a phone number, email support, and online form to leave a message. The lack of a hotline is another big red flag. There is no live chat either to connect with the broker directly. Low rank in this regard as well.

Education at CP Markets

No educational resources are available on the CP Markets website as of now which is disappointing. While this should be addressed as soon as possible we still prefer that the broker becomes regulated and addresses big red flags first.

There are no market research tools like the economic calendar offered as well.

Should you consider CP Markets – final verdict

As we can see from our CP Markets review, our opinion of CP Markets is very negative. The broker tries to look legit, but after a little research, we found several big red flags. CP Markets is an offshore broker and the customers of it are not protected from the scam and wrongdoing. It lies about the year the company was founded. There are no CP Market reviews made by the customers and social media pages do not have any followers. The brokerage does not care to provide sufficient information about the service it is providing and traders cannot learn the important features of it until they register with CP Markets.

To sum up, it is not the broker one can trust, hence, instead of falling into the scam and losing your time and money, it is better to find a legit and good international broker and open an account with it.

Is CP Markets a good broker?

What are the fees and spreads of CP Markets?

What are the account types and deposit requirements of CP Markets?