Important Notice:

After the 13th of February 2022, the trading terms and conditions changed. Account types were reduced in number and lower initial deposit requirements were introduced. We will only refer to these new terms and fees in our revised edition of this review.

1Market Forex Broker is an online financial platform, offering over 600 assets to its customers. The company claims to be a trusted broker, giving away a lot of possibilities for online trading. At first glance, the main webpage looks quite attractive, offering customers all the valuable information that one might need in the decision-making process. We decided to do our research and find out whether this company can be recommended to you or not.

Under the trading conditions section, traders can find information about leverages. The maximum leverage is up to 1:30, it is the same for all account types as per regulations. As for spreads, 1.8 pips of variable spreads are offered on EUR/USD. 1Market FX Brokerage is rich in terms of trading tools and one can take advantage of Webtrader, and Metatrader 5, which is one of the most popular tools available on the market and used by the most reputable forex brokerage companies.

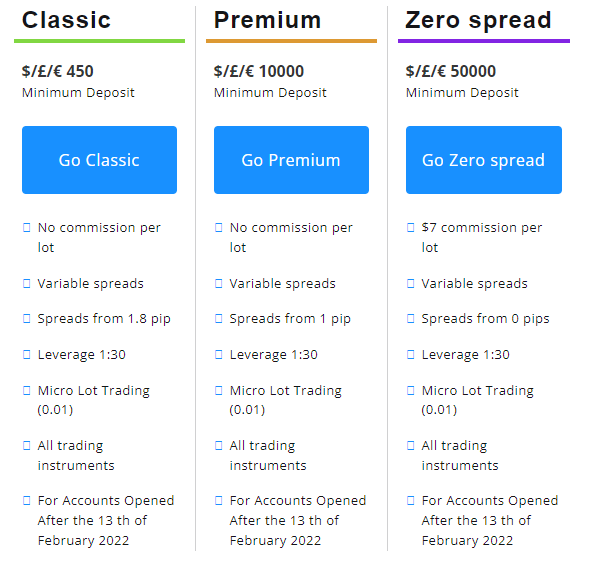

The minimum deposit amount used to be 500 USD, but the firm lowered it slightly to 450 USD or the equivalent in GBP and EUR. Traders can open up to three different types of accounts, including classic, premium, and zero spread. We could not find any information about bonuses and promotional offers. Considering the fact that the website is wealthy in terms of information, we assume that they do not have any bonuses. It is possible to trade Currencies, commodities, CFDs, Indices, ETFs, and stocks.

The safety and security of the 1Market

Yes, 1 Market is a legit Forex broker. The broker used to be regulated by CySEC but recently replaced it with an even more strict and reputable regulator, which can be seen as a positive step towards improvement for 1Market. As we already mentioned earlier in this review, the company is fully regulated and licensed by MiFID (Markets in Financial Instruments Directive), giving them the authorization to offer financial services to customers throughout the European Union. This is a guarantee that if something inconvenient happens (e.g. they steal your money), there is a financial regulatory body that will take all the necessary actions in order to protect you from negative consequences. The proper regulation is something that protects traders from potential scams and lets them keep their funds in safe hands – meaning that your money will only be used for trading purposes and nothing else. The only downside to these strict regulations is the maximum leverage is limited by the law to just 1:30 which is low and takes away flexibility for experienced traders to trade with a low budget, but still control considerable buying power.

1Market Fees and spreads

In order to find out whether this platform is worth your time and money, we decided to do a more detailed review of its trading fees and spreads, so you will make your decision based on all the valuable information that affects the decision-making process.

All spreads at 1Market are variable. It is important to note that they may vary depending on market trading conditions, which mostly are volatile. Variable spreads of 1Market start from 1.8 pips on the classic account. Which can be considered quite expensive compared to the industry’s average of 1 pip. The zero spread account has spreads from 0 pips, but the trading commission is 7 USD per lot. There is no information if this commission is round turn or per side per lot.

The exact list of commissions for each asset type are as follows (per 1 lot traded):

- Forex – 7 USD

- Commodities – 7 USD

- Indices – 1 USD

- Stocks $0.1 per 1 stock (Min $0.05)

- ETFs $0.1 per 1 ETF (Min $0.05)

- Crypto 0.5% per volume

Leverage

The maximum leverage for customers used to be up to 1:400, but was reduced to 1:30 as of MiFID restrictions. While this new policy of leverage is good for beginners as it prevents them from overleveraged trading, it can be seen as a downside for experienced traders as they won’t be able to control large positions with small capital. ESMA guidelines restrict retail traders and the available leverage for them is up to 1:30, which helps traders reduce the risk of their funds. Generally, leverage allows customers to increase the size of their position many times and is like a double-edged sword as it can amplify both profits and losses.

1Market Accounts, deposits, and withdrawals

Once you decide to sign up for 1Market, you will be given free choice to choose from three different types of accounts which were recently introduced. Each of them comes with different specifications and requirements, and they also offer specific benefits. The higher types of accounts may offer exclusive market updates and personal notifications as well. A demo trading account option is also available, meaning that you can test out their services for free, without risking any of your financial activities. The spreads are only attractive on the Premium account. While the commission is industry-average on Zero spread accounts. Since many popular brokers offer lower minimum deposits for this kind of zero-spread account, there are no advantages from 1Market in this regard.

Deposits and withdrawals

The minimum deposit requirement for the lowest account type is set at 450 dollars, which ის above the industry’s average (it is somewhere between 50 and 100 USD). The other types of accounts require you to deposit more, and the amount of them starts from 10,000 USD for the premium and can go up to 50,000 USD for the Zero spread. We need to mention the fact that there are a lot of other platforms where the minimum deposit requirement may be much lower, and it is up to you to decide which one you decide to choose. There is no information on the broker’s website regarding deposits and withdrawals, fees, and methods available. There is no live chat to contact them and ask about these details. This makes it possible that broker has high fees for these transactions. In this case, traders should avoid this broker, as there are many well-established brokers offering much more appealing services to traders.

1Market Trading assets and features

1Market offers a wide range of trading asset classes including Forex currencies, commodities, indices, ETFs, and stocks. The broker offers information about crypto fees but has not included it in the tradable assets list. Maybe they removed it after a recent update. All major pairs and many minor pairs are offered for trading. From commodities, oil, and gold are available together with popular assets. The broker is shy of providing the exact list of tradable instruments on their website, which is a huge downside of the 1Market broker. It would be better if they focused more on what they offer rather than some general explanations of each trading asset class.

1Market Customer Support Review

The lack of live chat makes it very difficult to contact 1Market support. In case of issues during trading processes, it will take some time to reach broker support. This is one of the biggest downsides of this broker. Live chat is the most cost and time-effective way to connect with the broker directly and get answers to your questions. The lack of it makes the process long and exhausting. Available support options include a hotline number, email address, and online for to leave a message to the broker. The website is available in many different languages, which is a positive sign.

Education at 1Market

1Market focuses on educational resources the most on its website. They have plenty of resources for beginners to get basic knowledge about financial markets. There are vast amounts of articles on each topic including Forex, indices, commodities, indices, and stock trading. These assets are CFDs, and the broker has articles to teach beginners the peculiarities of these derivatives. Each of these topics consists of numerous themes like trading psychology, trading strategies, and basic explanations of what these markets are. Fundamental analysis, technical analysis, scalping, and various other important concepts can be understood from these resources that make 1Market a very good source of educational knowledge. The broker offers a demo account to test this knowledge in live markets without losing real money.

Should you consider 1Market?

Finally, we do believe that this platform definitely has some good qualities, including the reputable license which guarantees your safe trading, but with all the other trading features that may be a little excessive, we do not recommend you to use this 1Market as your trading destination unless you have at least 10 000 USD trading capital to get 1 pip spread on the commission-free account. The expensive spreads this broker offers start from 1.8 pips, which is way beyond the industry average.

Is 1Market a reliable broker?

What is the maximum leverage offered by 1Market?