Table of content

The essential rollover rate definition is that it represents the differential between the yield of a purchased currency and the interest rate of sold currency, minus broker commissions.

This is also known as interest swap since what happens here is that the trader swaps interest payments of one currency to another. For example, by June 2020, the Bank of Canada keeps its key interest rate at 0.25%, while at the same time the European Central Bank holds its rate at 0%. This means that the interest rate differential between those 2 currencies is 0.25%.

Let us suppose that the broker’s commission is 0.1%. In this case, if traders open short EUR/CAD trade then for every day they keep this position open, the broker will pay 0.15% annual interest to their accounts. On the other hand, if the market participants open a long EUR/CAD position, then they have to pay an annual 0.35% interest to the broker.

Traders can avoid rollover fees in Forex in several ways. The first, the most obvious way to achieve this is to close all positions before the end of the trading day. This is what usually scalpers and day traders do.

Secondly, market participants can look for those brokers who do not charge rollover fees. Some brokerage companies even have a special trading account with no swap charges. The flip side of the coin here is that brokers do not pay any rollover payments either and typically make up the loss by higher spreads or other commissions.

Finally, traders can focus on opening those positions which have a positive rollover, so that they will receive some income, instead of paying daily interest to brokers. This is essentially how do carry trades operate in the Forex market.

Each of those methods described above has its own advantages and disadvantages, something we will discuss in more detail later in this article.

Understanding Forex Rollover Rates

The basic idea behind any Forex trade is that a trader borrows one currency in order to buy another. As it is well known, all major central banks around the world set the key interest rates for their respective currencies. Because of this tendency, very often there are interest rate differentials between two currencies in a given currency pair.

If traders close their positions before the end of the trading day, then they do not pay or receive any interest in holding their trades. On the other hand, if traders keep their position open overnight, then they might be subject to rollover charges.

Here some people might wonder how to calculate the rollover rate. The first step is to calculate the interest rate differential between the two currencies in a given currency pair. For example, let us suppose that a trader decides to open a long GBP/AUD position. By June 2020, the Bank of England keeps its interest rates at 0.1%, when the Reserve Bank of Australia has its rates at 0.25%. So, in this case, the interest rate differential will be 0.15%.

So does this mean that a trader will receive 0.15% annual interest for holding a short GBP/AUD position and will be charged 0.15% annual interest for holding on to the long GBP/AUD trade? Well, that is not the case. All brokers have their own commissions, which is part of the equation. Some carry traders might hold on to their positions for months, so it makes very little sense to brokerage companies not to earn some income from those operations.

Returning to our previous example, if a commission rate of a given broker is 0.1%, then a trader will receive a 0.05% annual interest for keeping a short GBP/AUD position and have to pay a 0.25% annual interest for holding on to a long GBP/AUD trade. So this is the essence of what Is the rollover rate.

In order to simplify those calculations, the majority of Forex brokerage companies have the rollover calculator at their websites. This lets traders bypass percentage calculations. Here they can enter the currency pair, the amount of trade, and the chart will display the daily amount a trader will receive or pay for keeping this position open.

There is no standard rollover rate for brokerage companies. Instead, each of them has its own specific rates and policies. Some of them do offer much more competitive rollover rates than others. Therefore, it can be always helpful to research the latest swap rates of several brokerage firms, before opening an account and starting trading. For example, a 0.2% difference might seem too trivial to make any difference, however, in the long term this differential can indeed add up to a significant amount.

When it comes to comparing brokers, it is essential to point out that they usually do not display their rollover commissions as percentage rates. Instead, traders can utilize their swap calculators to check the difference between brokerage companies.

Closing Trades Before End of Trading Day

There are at least two categories of traders who liquidate all of their positions before the market closes at the end of each trading day. Those include scalpers and day traders. The first category involves market participants who typically trade with a 1 to a 15-minute timeframe in mind. This is obviously a highly risky strategy and can be stressful for some market participants. However, some experienced traders use this trading style on a regular basis with a reasonable amount of success.

The second group of those individuals is represented by day traders. The timeframe of their trades can last up to several hours, however, most of them do close all of their positions before the closing of the trading day. This has two important advantages. Firstly, this is helpful because many traders are avoiding Forex rollover fees in this way.

Market participants might identify a potentially profitable trading opportunity, which includes the purchase of lower-yielding currency against the higher-yielding currency. Therefore, day trading is one way to do this without any additional charges. The second additional benefit to this approach is that traders can avoid risks associated with overnight exchange rate movements.

To illustrate this, let us take a look at this 15-minute EUR/USD chart:

As we can see from the above diagram, the most liquid currency pair in the Forex market experienced a great deal of fluctuation during the last 12 days of trading. Here we can identify two major trends. The first one began once the EUR/USD has reached $1.1347. This marked the beginning of a downward trend, which continued until June 22, the time when the pair has already dropped all the way down to $1.1170.

So if at this stage a trader decided to capitalize on this downtrend and kept the position open for overnight, then he or she might have faced an unpleasant surprise. From the next day, the pair has appreciated sharply and eventually reached the $1.1320 level. Therefore some traders look at day trading style as a risk reduction strategy.

Despite those two distinct benefits, this method does have some disadvantages as well. After analyzing the fundamentals of currencies, real and nominal interest rate differentials, economic indicators, and central bank policies, traders can often make accurate predictions about the future path of exchange rates. However, it is much more difficult to do this on a daily basis, where the market can be very unpredictable. This strategy also requires monitoring currency markets several hours per day, which might be impossible for people with other full-time jobs.

Therefore this day trading can be too stressful for some market participants. However, the list of its disadvantages does not end here. Day trading does involve executing a large number of trades since each of them has a spread, traders can still end up paying a significant amount to brokers with those fees, without paying any rollover interest payments. On the other hand, with swing or long term trading, the actual number of trades is much lower and as a result, the trader spends less amount of money on spreads.

Finding Forex Accounts without Rollover Fees

Another obvious choice for avoiding Forex rollover is to find the account, which does not have any swap charges. This can be achieved in two ways. There are some brokerage companies that have accounts, specifically designed for this purpose.

However, here comes the obvious question: Why would a broker let go of the potential rollover charges? Well, there can be at least three reasons for this:

- The fact that brokerage companies subtract rollover charges from some accounts does not necessarily mean that they keep all those amounts as revenue. Brokerage firm does have to cover its own borrowing costs. Therefore, most of those sums are spent on those expenses and the company only retains a small portion of the interest swaps.

- In some cases, depending on position and a specific currency pair, with normal accounts, brokers have to pay daily rollover to their clients. However, when it comes to swap-free accounts, brokerage companies can retain those payments for themselves.

- Brokers do make up the lost revenues with swap-free accounts by widening spreads or alternatively, charging fixed commissions per trade.

Here it is helpful to mention that some brokerage firms do not have a special rollover-free account. However, those clients who are aiming at avoiding rollover charges, can contact those companies and ask for a swap-free deal. Very often the brokerage firms are willing to consider those offers since they understand that if they reject it, they will just lose a potential client to one of their competitors, which is not the best business strategy.

Those types of accounts can be very beneficial for many traders, especially for those who like to open long positions with low-yielding currencies. There can be several scenarios when this can happen. To illustrate one example of this, let us take a look at this daily EUR/CHF chart:

As we can see from the above image, through late 2017 and early 2018 the Euro has made substantial gains against the Swiss Franc, rising from 1.08 level in June 2017 to 1.20 by April 2018. However, at this time the tide has turned and EUR/CHF entered into a steady downtrend for the next 2 years, eventually dropping all the way down to 1.05 level by May 2020.

It goes without saying that throughout this period many traders would have noticed the obvious downtrend the Euro was engaged in and some of them might decide to capitalize on this trading opportunity.

However, there was one problem. While the European Central Bank kept its key interest rate at 0%, the Swiss National Bank reduced its own rates all the way down to -0.75%. Consequently, if a trader wants to open a long EUR/CHF position, then his or her account will be subject to daily rollover charges, as long as the trade is not liquidated. Therefore, in this case, having a swap-free account can be very beneficial since it lets a market participant capitalize on this trading opportunity without paying large amounts of money in rollover fees.

So as we can see this approach can certainly have some tangible benefits. However, it has some downsides as well. Firstly, traders will face wider spreads or fixed commissions per trade. For a few trading days, this might make very little difference. However, over the months those additional charges can add up to a considerable amount.

Opening Positions with Positive Rollover Rates

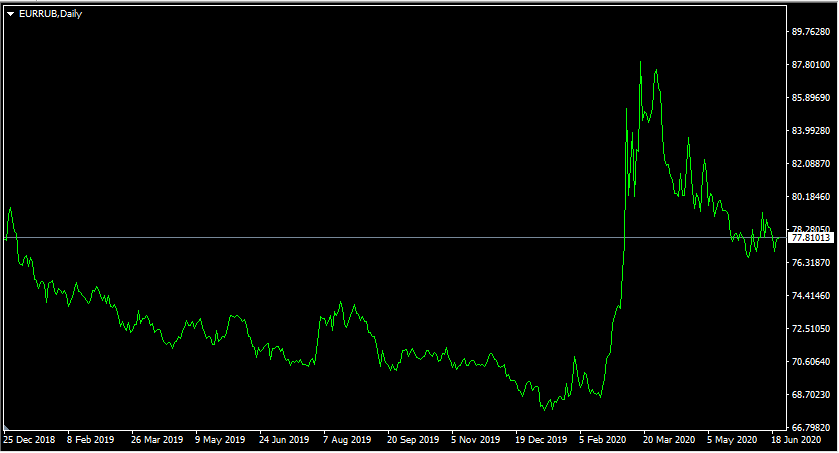

The second major disadvantage of swap=free types of accounts is that if traders buy a higher-yielding currency against the lower-yielding currency, they will not be able to receive any daily income from the broker. Here we can take a look at a similar scenario, on this daily EUR/RUB chart:

As we can see from the chart above, through 2019 the Russian Ruble has appreciated steadily, with EUR/RUB exchange rate falling from 78 to 68 by the end of the year. The Russian currency depreciated rapidly after the outbreak of the COVID-19 pandemic. As a result, during March 2020 EUR/RUB pair has gone all the way up to 88 mark. Despite this development, the situation later normalized and the pair dropped down to 78 level. So as we can see, despite all of the drama surrounding those currencies, the exchange rate between them eventually returned back to January 2018 levels.

So if traders kept the short EUR/RUB position open for all this period, they would not make any gains with swap-free accounts. However, if they used just a regular account, they would have earned a significant amount of income. As mentioned before, the European Central Bank is still holding on to its 0% interest rate policy. However, at the same time, the Bank of Russia is keeping its rates at 5.5%.

So if traders kept the short EUR/RUB position opened for 18 months, they would have earned an 8.25% return on that investment. With one standard lot, which includes 100,000 units of currency, a trader can earn up to $8,250 in total or $458 per month. With 2:1 leverage, trading with 2 lots the total return on this trade would reach 16.50%, which amounts to $916 per month or $16,500 in 18 months.

Here it is worth mentioning that if an interest rate differential between two currencies is 5.5%, it does not mean that the broker will pay exactly this rate of return to its clients. As mentioned before, each brokerage company retains a certain percentage of carry trades as commission. The exact amount of this expense depends on the policies of the brokerage company. Some of them might take as little as 0.1%, while more expensive ones might retain as much as 0.5%. So this is why it always pays to shop around when choosing brokers.

Therefore, as we can see from this example, traders have the third option. Instead of accepting larger spreads or paying fixed commissions per trader, traders can limit their choices to positions that involve buying higher-yielding currencies against lower-yielding ones. This strategy is also known as carry trading and is still popular among the trader community.

In many ways, this can be a decent Forex rollover strategy. Here the trader can still benefit from low competitive spreads, avoid any fixed commissions per trade and at the same time, do not pay any rollover charges. This seems like an all-round good deal. However, just like in the first two cases, this approach also has its own disadvantages.

When discussing this method, it is important to mention that it does limit the choice of positions traders can take. Everything else being equal the market does tend to favor high-yielding currencies over the low-yielding ones. However, there can be many scenarios where this might not be the case:

- Due to weak economic performance indicators, such as low Gross Domestic Product growth rate, high unemployment or falling retail sales, the market might decide that the central bank of high-yielding currency is very likely to cut rates considerably in the future, therefore, it may fall in anticipation of those changes.

- The high-yielding currency might be suffering from a high rate of inflation. As a result, the real yield on the currency might be very low or even negative, depending on the central bank rate and the latest Consumer Price Index (CPI) numbers. As a result, deposits in this currency might be losing their purchasing power and therefore it became unattractive to potential investors and traders.

- In a given currency pair, the lower-yielding currency might start to appreciate due to improving economic performance. As a result, traders can start purchasing this currency, in anticipation of central bank rate hikes.

- The low-yielding currency can have a much lower average rate of inflation, compared to most of its peers. As a result, due to the Purchasing Power Parity effect, the goods and services in this country can become cheaper than its competitors. The increasing demand for the nation’s products also tends to benefit the currency in question as well. Also, since it retains its purchasing power more effectively than other currencies, it becomes more attractive for investors. As a result, the currency can benefit from steady long term appreciation against its peers.

As we can see from the above, there can be plenty of scenarios, where lower-yielding currency might be favored by the market, so limiting oneself to only high-yielding currencies can be problematic for some traders.

Avoiding Rollover Charges – Key Takeaways

- Rollover charges occur when a trader buys a lower-yielding currency against the higher-yielding currency and holds this position open overnight. The exact amount of the fee depends on several factors, including interest rate differentials, the commission structure of the brokerage company, and the size of the given position. When a trader purchases a high-yielding currency against a lower-yielding currency, then instead of paying any fees, he or she receives daily interest swaps, as long as the position remains open.

- Trades can avoid rollover charges altogether in three ways. They can limit their activities to day trading, closing all of their positions before the end of each trading day. They can also take advantage of swap-free trading accounts, which some brokers do offer on their websites. Finally, traders can limit their trading choices to higher-yielding currencies and receive some daily income in the process.

- Each of those three methods does have its own advantages and disadvantages. Day trading can be a very risky and stressful experience for some traders. Swap-free accounts are usually accompanied by wider spreads on currency pairs or alternatively, fixed commissions for each trader. Finally, taking only positions with higher-yielding currencies does limit a trader’s options, which can be problematic for some market participants. So the actual choice between those 3 options does depend upon a trader’s priorities and personal preferences.